Tax Brackets 2024 Capital Gains. As a result, janet would owe zero tax on about $5,000 of her gains and 15% on. Add this to your taxable income.

They are taxed at favorable rates of 0,. Add this to your taxable income.

For 2023, The 15% Bracket For Capital Gains Begins At $44,626 Of Taxable Income For Single Filers.

And for some, it's 0%.

2024 Federal Income Tax Brackets And Rates In 2024, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

For the 2023 to 2024 tax year the allowance is £6,000, which leaves £6,600 to pay tax on.

Because The Combined Amount Of £26,600 Is Less Than.

Images References :

Source: bobbyeqestrella.pages.dev

Source: bobbyeqestrella.pages.dev

What Are The 2024 Tax Brackets For Married Filing Jointly Issi Charisse, They are taxed at favorable rates of 0,. For 2023, the 15% bracket for capital gains begins at $44,626 of taxable income for single filers.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Capital Gains Tax Brackets For 2023 And 2024, As a result, janet would owe zero tax on about $5,000 of her. Married filing jointly, eligible surviving spouses:

Source: www.harrypoint.com

Source: www.harrypoint.com

ShortTerm And LongTerm Capital Gains Tax Rates By, 2023 2024 capital gains tax. The rules will apply to taxes that will be filed in.

Source: e.tpg-web.com

Source: e.tpg-web.com

Cuddy Financial Services's Tax Planning Guide 2022 Tax Planning Guide, And for some, it's 0%. For 2023, the 15% bracket for capital gains begins at $44,626 of taxable income for single filers.

Source: blog.commonwealth.com

Source: blog.commonwealth.com

Understanding the Capital Gains Tax A Case Study, The adjustments are sizeable, with both income tax brackets and the standard deduction up by more than 5%. What is the current tax rate on capital gains and dividends?

Source: www.bilibili.com

Source: www.bilibili.com

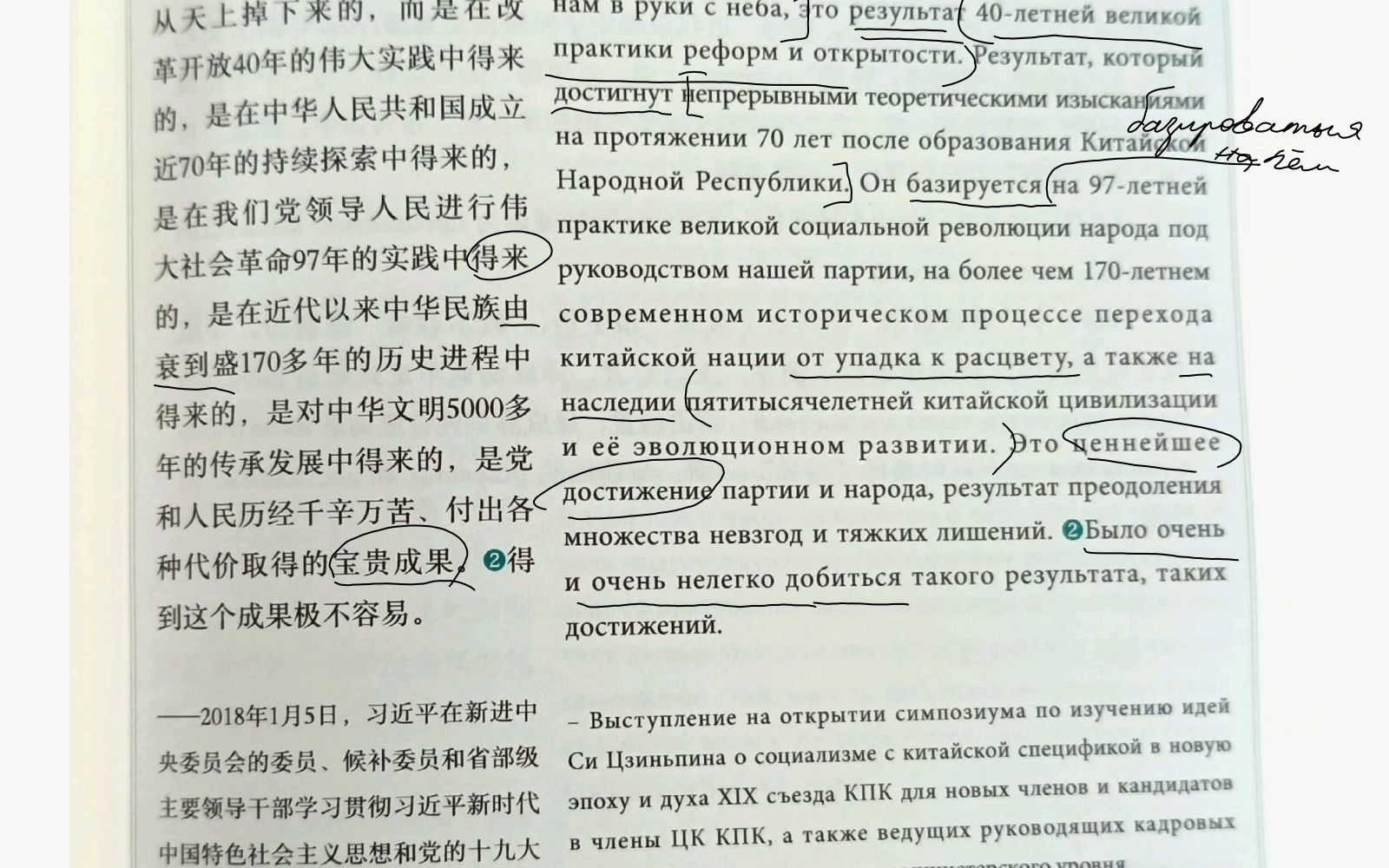

今天七一,浅学一篇应景的汉俄翻译 哔哩哔哩, They are taxed at favorable rates of 0,. Married filing jointly, eligible surviving spouses:

Source: taxrise.com

Source: taxrise.com

Cryptocurrency Taxes A Complete Tax Guide For All Cryptocurrencies For, In 2024, the tax brackets for capital gains are divided into three categories: For the highest earners in the.

Source: neswblogs.com

Source: neswblogs.com

2022 Va Tax Brackets Latest News Update, The irs uses ordinary income tax rates to tax capital gains. For the 2023 to 2024 tax year the allowance is £6,000, which leaves £6,600 to pay tax on.

Source: haipernews.com

Source: haipernews.com

How To Calculate Your Marginal Tax Rate Haiper, For 2023, the 15% bracket for capital gains begins at $44,626 of taxable income for single filers. For the highest earners in the.

Cryptos & taxes What you need to know The Token Tracker, The rules will apply to taxes that will be filed in. In 2024, the tax brackets for capital gains are divided into three categories:

2024 Federal Income Tax Brackets And Rates In 2024, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

And for some, it's 0%.

2023 2024 Capital Gains Tax.

The rules will apply to taxes that will be filed in.